Dan Charles

10/09/2025

Table of Contents

Key Takeaways

- Corporate buyers use AI tools 58% more than average Americans – they’re building sophisticated research workflows while most agencies still focus on social media

- ChatGPT dominates usage (70.3%) but Perplexity leads over-indexing (+69.7%) – showing corporate buyers layer specialized AI tools for different research phases

- They’re having conversations with AI, not searching keywords – asking complex questions like “What should I look for in a pharmaceutical event agency?” instead of “event planner Chicago”

- Google remains critical (96% usage) but frequency is strategic – corporate buyers use traditional search more purposefully than typical consumers

- Content must serve both traditional SEO and AI conversation contexts – agencies need multi-modal optimization while competitors chase outdated keyword strategies

Why your most valuable prospects are building sophisticated AI research stacks – and what this means for your content strategy

Your corporate event clients aren’t just early AI adopters – they’re building sophisticated research systems that most event agencies don’t even know exist.

New audience research reveals that corporate event buyers use AI tools an average of 58% more than typical Americans. While ChatGPT dominates with 70.3% usage, corporate buyers are also heavily over-indexing on specialized business AI tools: Perplexity.ai at +69.7% above average and Claude.ai at +57% above average.

This isn’t just about using AI – it’s about how corporate buyers are fundamentally changing their vendor research process.

The Multi-Layered AI Research Stack

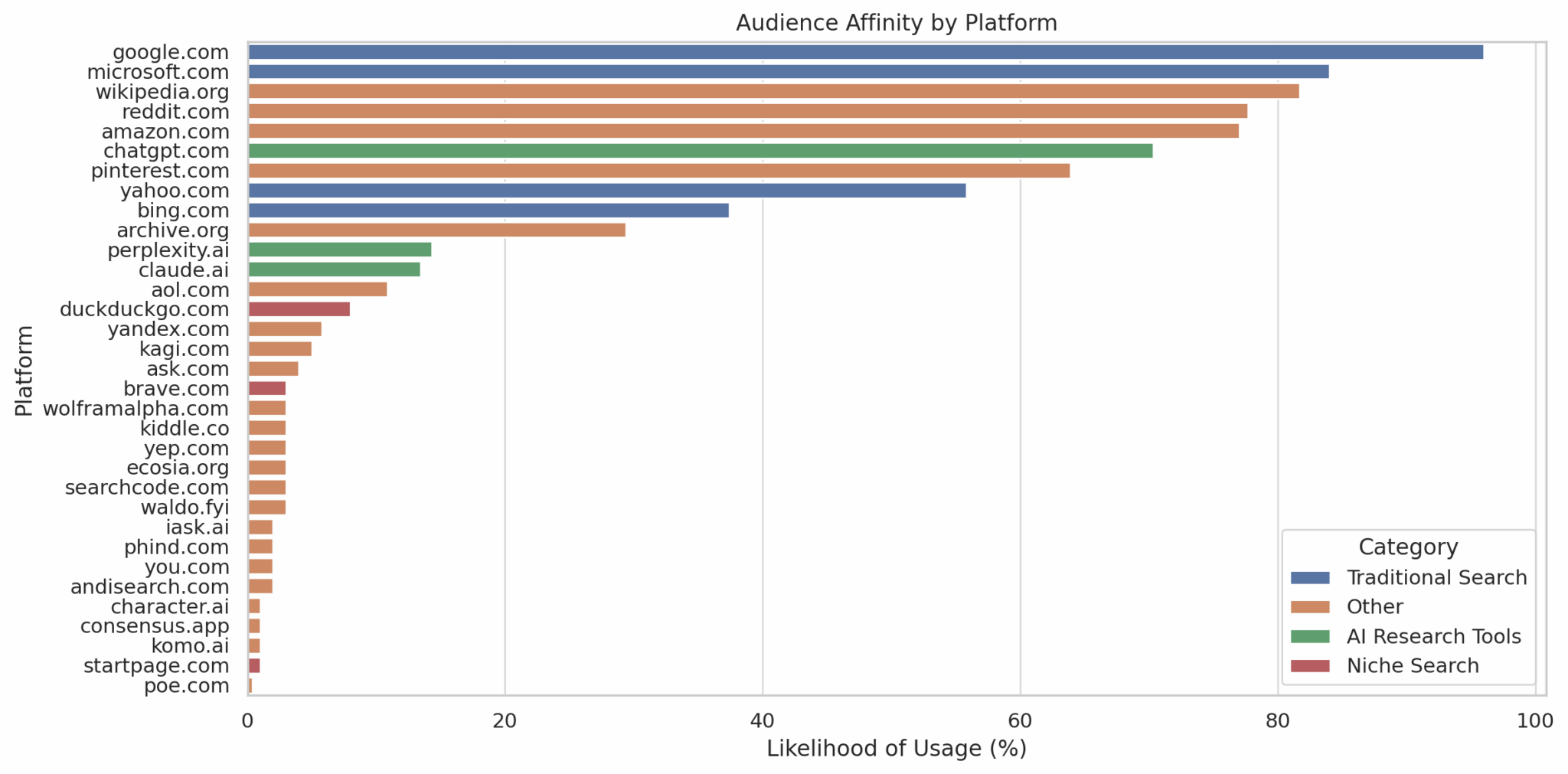

This bar chart shows the likelihood of mid-to-large event businesses using major search engines and AI platforms. Google dominates with over 90% likelihood, while AI tools like ChatGPT are quickly gaining traction compared to traditional alternatives.

Corporate buyers aren’t replacing traditional search – they’re layering AI tools on top to create more sophisticated research workflows.

AI Platform Usage vs US Average:

- Perplexity.ai: 14.3% likelihood, +69.7% above average

- Claude.ai: 13.4% likelihood, +57% above average

- ChatGPT: 70.3% likelihood, +47.7% above average

- Average AI overperformance: +58.1% across major platforms

This aligns with broader industry trends showing 75% AI adoption rates, indicating mainstream corporate adoption.

Traditional Search Patterns:

- Google: 96% likelihood, -2.5% vs average (high usage, more strategic)

- Microsoft platforms: 84% likelihood, +7.2% above average

What’s happening here? Corporate buyers are constructing specialized research workflows where each AI tool serves a distinct purpose in their vendor evaluation process.

AI Tool Specialization by Use Case

Corporate buyers aren’t randomly using AI tools – they’re developing sophisticated workflows that leverage each platform’s strengths.

ChatGPT (70.3% usage, +47.7% above average): The first-mover advantage means ChatGPT has the broadest adoption, serving as the “Swiss Army knife” for general business questions and initial vendor research. Research shows general-purpose AI dominance over niche event tools, used for copywriting, social media and email content creation, poster design, video editing, and marketing analysis.

Typical usage: “Generate an RFP template for a 500-person conference” or “What questions should I ask event agencies during initial conversations?”

Perplexity.ai (+69.7% above average): Despite lower overall usage (14.3%), the massive over-indexing reveals its specialized value for corporate research. Perplexity’s combination of real-time web search, reliable citations, and suggested follow-up questions creates an exploratory research experience perfect for complex B2B vendor evaluation.

Typical usage: “Compare event production companies in Chicago with experience in pharmaceutical launches” – getting sourced, comprehensive comparisons with suggested additional research paths.

Claude.ai (+57% above average): Positioned as a business tool rather than consumer platform, Claude shows strong adoption among sophisticated users who need detailed analysis and professional-grade responses.

Typical usage: Complex vendor evaluation matrices, detailed requirement analysis, and strategic event planning guidance.

This specialization means your content needs to serve multiple AI research contexts, not just traditional keyword searches.

The Corporate Digital Transformation Context

The AI adoption patterns we’re seeing align with broader digital transformation trends in corporate events. Hybrid formats grew 20% in 2024, with 76% of organizers planning hybrid events in 2025, reflecting the importance of digital integration in corporate event strategies.

Moreover, 61% offer AI features, with matchmaking, content suggestions, and chatbots being most common. This creates an ecosystem where corporate buyers are increasingly comfortable with AI-powered tools across their entire event planning workflow.

Platform Abandonment Patterns: What Corporate Buyers Reject

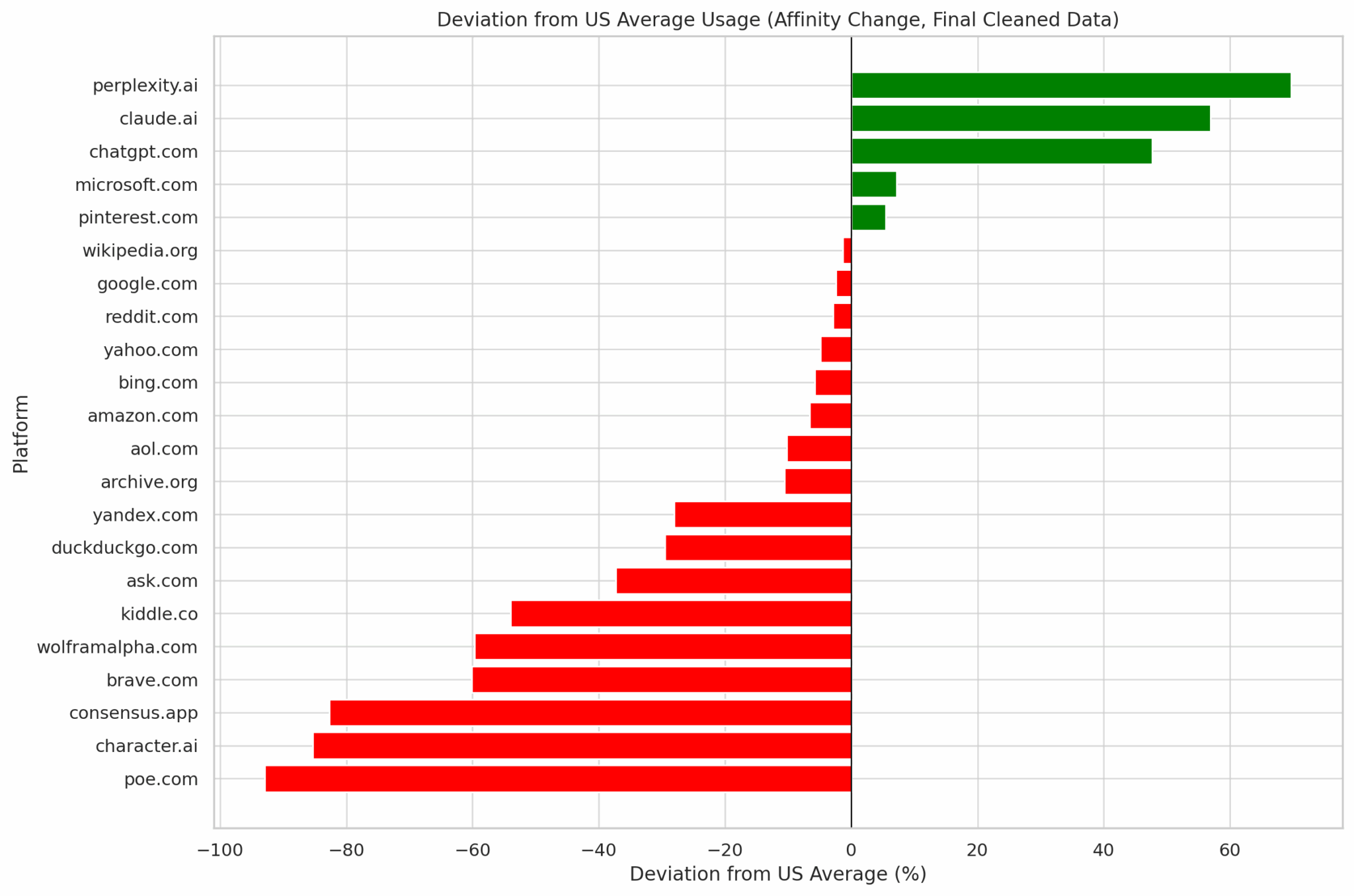

This diverging bar chart highlights which platforms event businesses use more or less than the average US company. Positive values indicate stronger usage among event professionals, while negative values signal weaker adoption compared to the US baseline.

The data reveals 17 platforms performing below US average usage – showing what corporate buyers explicitly avoid compared to typical internet users.

Significant Underperformers:

- DuckDuckGo: -29.5% below average

- Yandex: -28% below average

- Ask.com: -37.3% below average

- Brave: -60.2% below average

The Pattern: Corporate buyers reject alternative search engines and privacy-focused platforms in favor of mainstream, business-oriented tools with robust AI capabilities.

Why This Matters: Event agencies optimizing for niche platforms are missing their audience entirely. Corporate buyers want comprehensive, professional-grade research tools, not alternative or privacy-focused platforms.

The abandonment pattern shows corporate buyers prioritizing functionality and business value over privacy concerns or alternative platform philosophies.

ROI Implications: Where to Optimize Your Content Investment

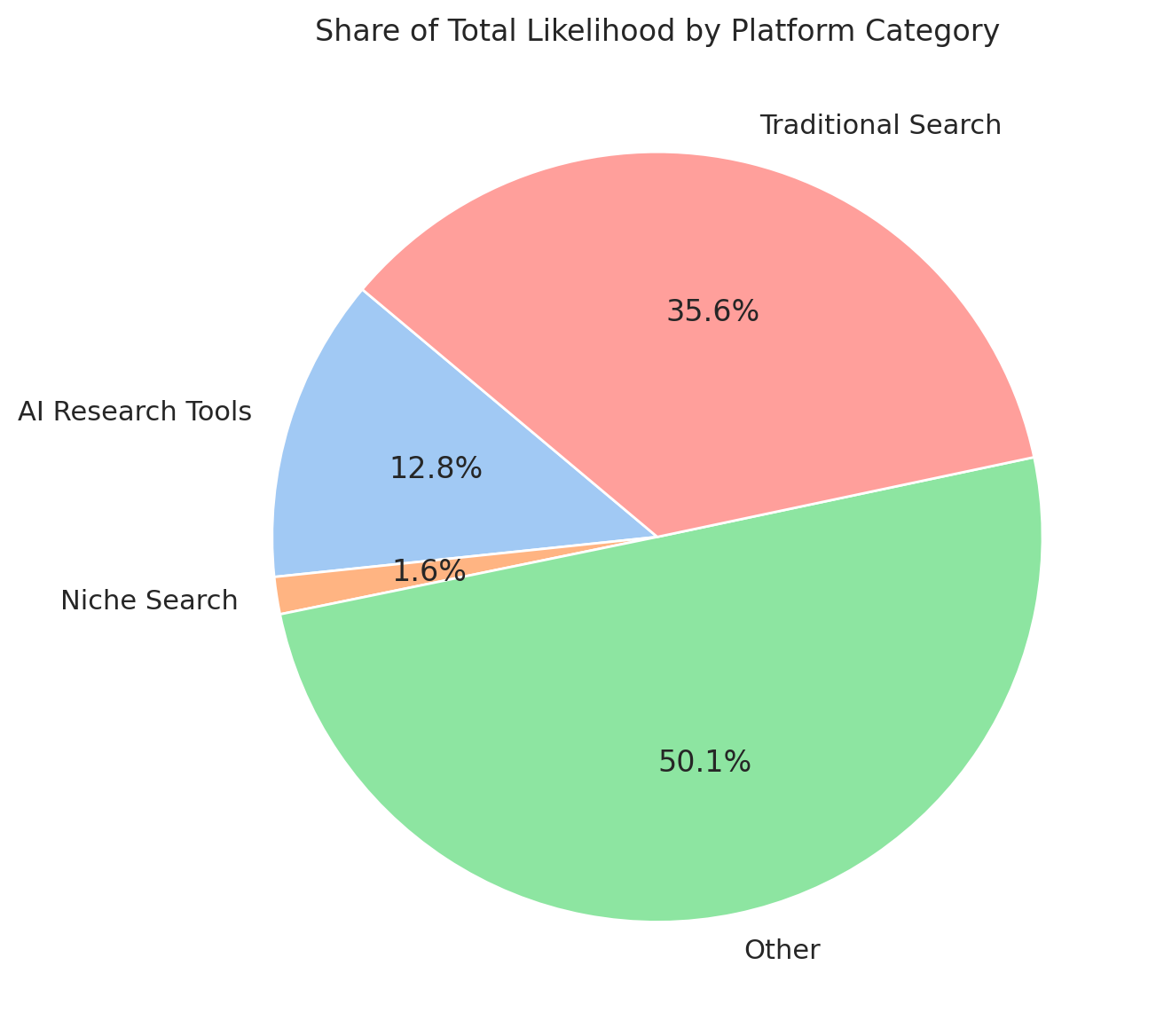

This pie chart shows the share of total likelihood by category: traditional search engines, AI research tools, and niche search platforms. Search still dominates overall, but AI platforms account for a growing share of usage among event businesses.

With corporate buyers using multiple AI platforms for specialized purposes, content optimization requires strategic prioritization.

Highest ROI Content Optimization Targets:

1. ChatGPT Optimization (70.3% likelihood)

- Investment Priority: High – broadest reach

- Content Focus: General business guidance, templated resources, initial vendor education

- Format: Comprehensive but accessible explanations that ChatGPT can easily parse and recommend

2. Google Strategic Optimization (96% likelihood)

- Investment Priority: Essential – still primary discovery channel

- Content Focus: Specific vendor information, portfolio details, contact information

- Approach: Targeted SEO for strategic searches rather than broad keyword coverage

3. Perplexity Research Integration (+69.7% above average)

- Investment Priority: High – massive over-indexing indicates specialized value

- Content Focus: Detailed comparative information, sourced insights, comprehensive vendor guides

- Format: Well-structured content that supports citation and comparison

4. Claude Business Applications (+57% above average)

- Investment Priority: Medium-High – growing sophisticated user base

- Content Focus: Strategic frameworks, detailed process explanations, professional guidance

- Format: In-depth analytical content for complex business decisions

Mathematical Reality: Optimizing for ChatGPT reaches 70.3% of your audience. Adding Perplexity optimization captures prospects who over-index by 69.7%. Combined approach covers both broad reach and specialized high-value research patterns.

The Budget Reality: Corporate buyers aren’t just experimenting with AI – they’re investing heavily. Research shows $500K+ technology budgets, with 23% prioritizing virtual events.

This substantial investment aligns with our analysis showing premium events consuming budgets while companies struggle with invisible ROI measurement.

The Conversation vs. Keywords Shift

Corporate buyers aren’t searching for “event agency Chicago” anymore – they’re having sophisticated conversations with AI tools about their specific needs.

Traditional Keyword Approach:

- “Corporate event planning”

- “Chicago event agency”

- “Conference planning services”

AI Conversation Reality:

- “What should I look for in an event agency for a pharmaceutical product launch?”

- “How do I evaluate event companies for a 500-person conference with complex AV requirements?”

- “What are the key differences between event production companies and event planning agencies?”

Content Strategy Implication: Your website needs to anticipate and answer the comprehensive questions corporate buyers are asking AI tools, not just rank for individual keywords.

The Persona Imperative: Understanding exactly how your ideal clients think, what approval processes they navigate, and what success looks like in their role becomes critical. AI tools are essentially having sophisticated conversations on behalf of these buyers – and if your content can’t contribute meaningfully to that conversation, you’re invisible.

Why Google’s AI Mode Matters for Event Agencies

Google’s rapid development of AI-powered search modes directly responds to Perplexity’s success in capturing corporate research behavior. This creates both opportunity and urgency for event agencies.

The Opportunity: Early optimization for AI-powered search experiences will provide competitive advantage as these tools become mainstream.

The Urgency: Corporate buyers are already using these tools heavily. Agencies that don’t adapt their content strategy will lose visibility as AI-mediated research becomes the norm.

Implementation Framework for Event Agencies

Phase 1: Conversation Audit Map the actual questions your ideal corporate clients ask during vendor research. Interview recent clients about their research process and questions they wished they could have answered before contacting agencies.

Phase 2: Multi-Modal Content Creation Develop content that serves both traditional SEO and AI conversation contexts:

- Comprehensive vendor comparison guides (Perplexity-friendly)

- Strategic planning frameworks (Claude-optimized)

- Practical templates and checklists (ChatGPT-accessible)

- Specific portfolio details (Google-discoverable)

Phase 3: AI Research Stack Testing Use Perplexity, ChatGPT, and Claude to research your own services. Identify gaps where AI tools can’t find or recommend your content, then fill those gaps systematically. Consider implementing AI sales systems to align with your prospects’ sophisticated technology expectations.

The Competitive Advantage Window

Most event agencies don’t realize their prospects are using AI tools 58% more than average Americans. While competitors chase social media metrics, corporate buyers are conducting sophisticated AI-powered vendor research.

The Reality Check:

- 96% of corporate buyers use Google, but more strategically than typical users

- 70.3% actively use ChatGPT for business questions

- They over-index massively on specialized research tools (+69.7% for Perplexity)

- They’re having conversations with AI, not searching for keywords

The Opportunity: Agencies that optimize for AI-mediated research while maintaining strong traditional SEO will capture disproportionate market share during this transition period.

The corporate buyers are already here, using AI tools extensively. The question is whether your content strategy has evolved to meet them where they’re actually researching.

Data Source: Audience analysis of mid-to-large businesses focused on events via SparkToro, representing corporations actively planning events as part of marketing strategy and internal functions. Analysis based on 33 search and AI platforms with statistical significance across corporate user segments.

Behind the Podcast: What Event Businesses Really Need to Break the Feast-or-Famine Cycle

The Real AI Revolution in Events Isn’t What Cvent’s Selling

Why Your Event Business Doesn’t Need More Martech: It Needs a Coherent Message